Startup Business Support Area

Starting a new business isn’t easy, that is why we have created our startup business area which is full of useful tips and advice from leading industry experts.

"*" indicates required fields

Request a callback within 24 hours

"*" indicates required fields

101 information for people starting businesses.

Startup Business Area

Starting a new business can be a mind boggling task and sometimes you will feel like you have a million things going through your mind, that is why we have created our startup business area.

At Edwards Bailey Chartered Accountants our goal is to help as many business owners as possible to achieve their personal and business goals, that is why we have created our startup business area to assist you with your startup business and make sure you get the foundations right, as well as have all the tips and advice that you need at your fingertips.

In our startup business area we have pulled together industry experts to assist with areas such as:

- Marketing

- Funding

- IT systems and security

- Business plan preparation

- Accreditations and certifications

- Whether you should start as a sole trader, partnership or a limited company

- How to structure your business for tax efficiency

- What records to keep and how to keep them

With any of the areas covered please feel free to contact us or our team of experts for further assistance and advice.

Register business - ST, P, LTD, PLC, etc

How to Structure a Start Up Business

At Edwards Bailey Chartered Accountants we often get asked what the best way is to structure a business but there is no black or white answer, it depends on several factors such as:

- The planned size of your operations

- Whether you will be working in a risky sector

- Whether you intend to take on employees

- Whether it is just you starting the business or whether there will be several owners

- Whether you have bad credit personally

Below we have provided details of some of the business structures that a start up business will commonly use and the pros and cons of each.

Should I Be Self Employed?

Being self employed, also known as being a sole trade, is one of the simplest business structures available to new business owners.

The main benefits of being a self employed sole trader are:

- It is cost effective.

- There are no complex filing requirements, as there are with owning a limited company.

- It is ideal for someone looking to test the water before they commit to setting up a limited company.

- Your accounts are not publicly available for all to see.

- You can easily convert your self employed sole trader business into a limited company down the line.

There are some down sides to being a self employed sole trader:

- It is not always the most tax effective business structure.

- You can pay higher rates of tax if you have other sources of income.

- You are taxed in the year that you make profits.

- If the company was to become insolvent, you would personally be liable for the debts.

- If the business is sued, you would personally be liable for damages and your personal assets could be at risk.

- If you have bad credit, it may be difficult to obtain funding or even open a business bank account.

You cannot have a business partner unless you setup a partnership (which we will cover in more detail below).

There are less tax planning opportunities as a self employed sole trader.

Should I Setup a Partnership

A partnership is effectively several sole traders joining forces to form a single business and again is one of the more simple approaches to setting up a business.

The main benefits of setting up a partnership are:

- It is cost effective.

- You can have as many business partners as you like.

- It is ideal for testing the water before committing to setting up a limited company.

- Your accounts are not publicly available for all to see.

- You can easily convert your partnership into a limited company down the line.

- You can share profits and tax liabilities between the business partners.

- There is more flexibility on how profits are shared between the business partners than in a limited company.

Some of the negatives of being a partnership are:

- It is not always the most tax effective business structure.

- You can pay higher rates of tax if you have other sources of income.

- You are taxed in the year that you make profits.

- If the partnership was to become insolvent, the business partners would personally be liable for the debts.

- If the business is sued, the business partners would personally be liable for damages and your personal assets could be at risk.

- If any of the partners have bad credit, it may be difficult to obtain funding or even open a business bank account.

- There are less tax planning opportunities as a partnership.

There are less regulations around how profits are shared between partners and what happens if a partner was to leave or pass away, that means to protect the business you will need a partnership agreement which will incur legal fees.

Should I Setup a Limited Company

A limited company is the most complex business structure in this article, but do not be put off by its complexity. If you have the right business advisor working with you, they can make the whole process straight forward and save you tax along the way.

Some of the benefits of operating your start up business as a limited company are:

- There are a lot of tax planning opportunities to help keep your tax as low as possible.

- The company is a separate legal entity from its owners, so if the company was to become insolvent, then only the company's assets are at risk, rather than your personal assets.

- If the business is sued, the owners would not be personally liable for damages and your personal assets are protected.

- You can take dividend income which is taxed at a lot lower rate than being self employed.

- It is easier to sell a limited company than it is a self employed sole trader or partnership business.

- Operating as a limited company can make your business seem more professional and appealing to potential customers.

- You can have several business owners and easily add new business owners as time goes by.

- If you have other sources of income there is more opportunity to make sure you are not paying tax at higher rates.

- The company is a separate legal entity from its owners, so if any of the owners have bad credit it will be easier to obtain finance and setup a business bank account.

Some of the negatives of operating as a limited company are:

- It is not the most cost effective method of setting up or operating a business, however any good accountant will save you more in tax than they charge you.

- There is less flexibility around who gets what share of the business profits, it is determined by who owns what percentage of shares.

- You accounts will be filed on public record for all to see.

- You will need to file a corporation tax return, as well as a personal tax return.

There are more stringent rules and regulations when it comes to operating as a limited company.

How Should I Structure My Start Up Business?

As you can see there are so many pros and cons for every business structure and there is no one size fits all solution. The best way to structure your start up business will depend on your personal circumstances and your plans.

Our team of Chartered Accountants are here to help you choose the best structure for your start up business .If you would like a free consultation to discuss the best approach for you please feel free to call us on 01708 200675, email us at info@edwardsbailey.co.uk or contact us via our website www.edwardsbailey.co.uk.

Marketing

Getting your marketing right when starting up as a new business can be the difference between success and failure. There are lots of free and paid versions of potential marketing avenues/platforms that we think you should take a look at and here we are going to break them down, and give you practical and actionable advice on where to start and what to do:

Google My Business

Cost: Free

Our Recommendation: 10/10

Link: https://business.google.com/create

Google My Business (GMB) is a free directory run my Google that allows businesses to register their address, put up their business products & services and tell the world what you do and how you do it.

Google My Business listings are incredibly powerful in attracting customers on a localised scale for people looking for you, or potentially more importantly, people looking for your products or services in a specific area.

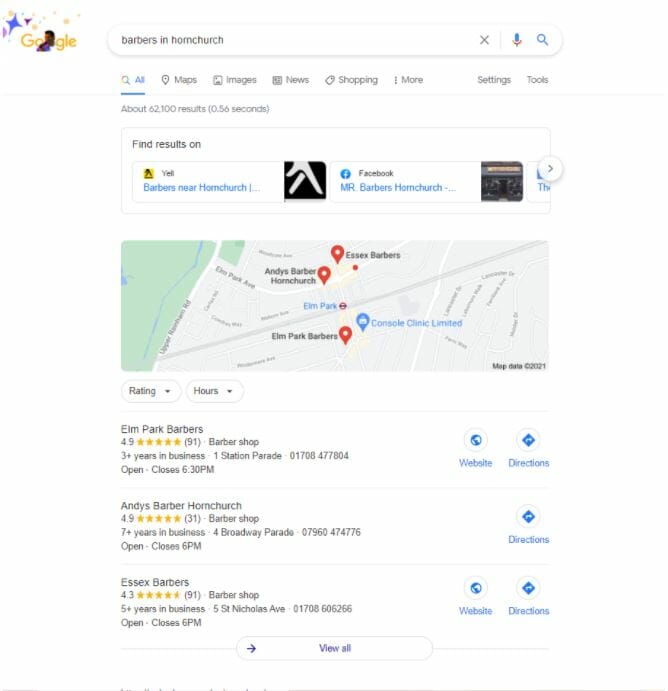

Here’s an example:

We have searched for a service + geographical area, in this example that is a barber in Hornchurch:

Here you can see 3 Google My Business listings, with their review score. Once you setup your Google My Business listing, they also give you a link to share with your existing clients to get your reviews up. Get this circulated to your nearest and dearest to help get your listing up the rankings and bring in dedicated listings.

Top tip

Fill in as much information as you can when you’re filling in the company information. This can be the difference between you outranking your competitors for the specific product or service that you offer.

Social Media

Cost: Free

Our Recommendation: 9/10

Links:

Facebook - https://www.facebook.com/pages/creation/

Twitter - https://twitter.com/i/flow/signup

LinkedIn - https://www.linkedin.com/company/setup/new/

Instagram - https://business.instagram.com/getting-started?locale=en_GB

Social Media is a very cost effective way of putting your business in the spotlight for potential customers that are looking for businesses like yours, but be warned it can also be damaging if you are not up to scratch and people want to vent about a poor product/service!

What social media channels should I use for my business?

This a great question, and we recommend flipping this question on it’s head. What platforms are your customers using? If you are looking at an older generation then Facebook is the market leader. Looking to sell B2B, get on LinkedIn. Want to give people upto date information, choose Twitter and for the younger market it’s Instagram.

Try to create content that has value and insight. We like to operate an 80/20 rule on active social media campaigns which means that 80% of all the content we push out is not direct sales. It’s giving your social media account value, and that helps potential customers engage with your business, see your value and then hopefully, enquire when their need arises.

We max out direct sales/special offers to a maximum of 20% (1 in 5) of our posts are things like special offers, price reductions and similar.

Website

Cost: Varies expect to pay £500 - £1500 for a basic website, £2500+ for a premium website

Our Recommendation: 10/10

Links: https://www.respondit.co.uk/

A website is a must have in this day and age and is simply your online shopfront. There are two major types of websites

Lead affirming and lead generating.

Lead affirming websites are generally there to support existing sales pushes and marketing funnels. An example would be your business is recommended to someone on Facebook. You exchange some messages back and forward and you provide a quote for the product or service you deliver. The customer then goes away and Googles your business. The customer looks at your website and decides you are a good fit for their specific needs. This is a lead affirming website.

A Lead generating website is when a potential customer is looking your particular product or service through search engines, normally Google and comes across your website. An example would normally be the product or service you offer plus a geographical place term.

*Product/Service + Geographical* = keyword

E.g.

Restaurant in London

A lead generating website should appear for a number of keywords specifically targeted for your business products and services,

The difference in the two is drastically important and will have a big impact on the amount you want to budget. With lead generating websites, you are paying for the website design AND the marketing attached with ranking higher on Google. We recommend talking to the guys at Respondit and they’ll provide you with a free no-obligation quotation.

Accounting - Best ways to position business for tax

How to Structure Your Business for Tax Purposes

We often get asked "how should I setup my business as a limited company or self employed?" and our answer is always the same, it depends on your personal circumstances and your future plans.

There is no one size fits all answer on how to structure your business, so we have covered some of the key points on the most common structures below.

Types of Company Structure

There are several ways to structure your business and all these structures have pros and cons, which we will cover below.

The most common business structures are:

- Self employed/sole trade

- Partnership

- Limited company

Self Employed/Sole Trader

This is by far the simplest business structure with less of an administrative burden and less strict regulatory requirements than a limited company or a limited liability partnership.

It is the perfect structure to start your small business and test the water before converting to a limited company.

The downside to being self employed is that you are offered no protection if things were to go wrong. As there is no distinction between you and your business your personal assets could be at risk if the business is unsuccessful.

From a tax perspective being self employed is not most tax effective business structure, but the difference in tax between being self employed and a limited company is minimal until you start making profits of around £30,000 a year.

Partnerships

Partnerships are effectively two or more sole traders or self employed individuals joining forces and the pros and cons are very similar to that of being self employed.

The main difference is that you will be required to file an additional partnership tax return and will incur higher legal fees for the preparation of a partnership agreement, which we would highly recommend in case of a fall out between the partners.

The tax rates for being a partner in a partnership are the same as being self employed, but the benefit is that taxable profits can be split between more individuals, making the most of their tax free allowances each year.

As an example you could start your business as a partnership with you and your wife/husband and utilise their tax free allowance each year if they have no other form of income.

As with being self employed, from a tax perspective being a partnership is not most tax effective business structure, but the difference in tax between being a partnership and a limited company is minimal until you start making profits of around £30,000 a year per partner.

Limited Company

A Limited company has the most difficult filing requirements and regulations of the business structure detailed above, however it has more flexibility from a tax perspective than being self employed or in a partnership and offers protection to your personal assets should the business fail.

As a limited company is a separate legal entity from yourself you personal assets are not at risk should the company fail.

This also means that from a tax perspective the income a company earns is not taxed on your personally until you take money out of your company, which can be beneficial if you have other forms of income apart from the limited company. The income you take out of your company can be in the form of a salary, dividends or a mix of the two (which we recommend).

From a tax perspective if your business is earning more than £30,000 a year then a limited company is the most tax efficient business structure.

The legal, operational and taxation requirements of a limited are far more complex than that of being self employed or a partnership, which can lead to higher professional fees, however these increased costs should be greatly outweighed by the tax savings you will make.

Conclusion

As you can see from the above, there is no right or wrong way to structure a business. The best approach will always depend on your circumstances.

That is why we highly recommend that you speak with an accountant to ensure your are starting on the right foot.

At Edwards Bailey Chartered Accountants we offer a free no obligation call to discuss your circumstances and advise on the best business structure for you, so please feel free to call us on 01708 200675, email us at info@edwardsbailey.co.uk or contact us through our website www.edwardsbailey.co.uk.

Corporate finance - start up loans

How to finance a business acquisition

The Office for National Statistics reports 178 completed business acquisitions for last year. Despite the pandemic, businesses continue to be acquired. So how do you finance a business acquisition? This article explains the various options available to businesses along with top tips.

Why acquire a business?

You may have decided that growth through acquisition

is a faster, more cost effective and less risky option for your

business.

Trying to grow your business organically can be expensive and time consuming with no guarantee of success. An acquisition offers a lot of advantages; you can eliminate competition, immediately increase your market penetration and enjoy significant savings due to economies of scale.

Other benefits include:

- Speed

An acquisition provides you with the opportunity to quickly acquire resources and core competencies not currently held by your company. It can additionally provide you with immediate access into markets and products, with an established brand and client base; something that may ordinarily take years to achieve. - Increased market share

An acquisition will quickly build market presence for your company, and can make life a lot more difficult for your competitors. - Reduced entry barriers

You may be considering an acquisition as a way of overcoming challenging market entry barriers, which can otherwise be a costly and time-consuming process.

How to finance the purchase

Unless you are able to pay cash for your acquisition, you will require some kind of financing in order to be successful.

Acquisition finance effectively becomes a choice between debt, equity or a combination of both.

Debt involves borrowing money to be repaid, plus interest, whilst equity involves raising money by selling shares in the company.

Debt vs Equity

A loan does not provide an ownership stake and, so, does not cause dilution to the owners’ equity position in the business.

In most cases, a lender will not have any claim on future profits of the business; they are only entitled to repayment of the loan.

Debt repayments are usually pre-agreed amounts that can fixed or variable amounts with interest being linked to agreed reference rates (most commonly Bank of England Base Rate) and these can be forecasted and planned for. However, unlike equity, debt must be repaid at some point.

You will usually be required to put assets of the company up as collateral for a loan, and may even be required to personally guarantee repayment of it.

Servicing debt repayments must be assessed to ensure that it does not become a significant cash flow burden to your business, and limit your future plans.

Let’s take a look at the most popular debt financing options for business acquisitions that Newable Finance can assist with.

Senior Debt

Senior debt is a secured term loan and as the name suggests it is debt that takes priority over other unsecured or ‘junior’ debt.

The term of the debt may vary with terms as long as 15-220 years available for long terms acquisitions with the debt carrying either fixed or variable interest rate.

To reduce repayment risk, fixed assets are frequently used as generally preferred collateral, however current assets, intangibles or even the borrower’s stock may be used as security.

Senior debt can also be extended to businesses that are asset light i.e. do not have much in the way of assets to be used as collateral.

Lenders will structure the facility as a cash flow-based loan; so instead of physical assets the lender is lending against a company’s cash flow (or EBITDA).

Loan size is determined as a multiple of EBITDA with 1.5 to 3.5 times being a typical range.

Senior loans may be structured with a capital repayment holiday (or interest only period) of up to two years,

Good for:

Well established businesses with strong management, good track record of profitability and sustainable cash flows

Mezzanine Debt

Mezzanine debt is a loan that can be converted to equity in case of default.

It is high risk and therefore expensive but it’s flexibility still makes it an attractive option for funding acquisitions.

It is usually provided on an interest only basis, making repayment more manageable than other debt structures.

Mezzanine is subordinate to senior debt but senior to common equity.

Mezzanine finance is a complex area of business funding, but it can be a useful way for companies to raise more money than would otherwise be possible based on the strength of the current business alone.

It also offers an alternative to selling large amounts of equity outright, which may be preferable for business owners wishing to keep as much control as possible.

Good for:

Businesses that can’t attract enough senior debt, but don’t want to dilute equity further – mezzanine fills the gap between debt and equity.

Asset Based Lending

Asset Based Lending (ABL) is the most popular alternative to bank financing for funding a business acquisition.

With ABL, you are able to use the assets of the company you are trying to buy (and your own company’s assets, if required) as collateral for a loan.

The asset-based lender will make advances at rates from 70% to 90% against assets including receivables, inventory, plant & machinery and property.

It is popular because, depending on the strength of the company’s asset base, it is a very effective method of generating capital that may not be accessible through traditional lending facilities.

Good for:

Businesses with good management, systems and controls and a strong asset base.

5 tips for a successful acquisition

Common objectives

Firstly, make sure that both businesses have shared business goals and objectives.

Do a lot of research and ask a lot of questions to identify any areas that you may disagree on or are likely to cause friction between the two businesses.

You should be able to establish some common ground in terms of the overall mission of each business, to confirm that the acquisition is in the best interests of both companies.

Planning

There’s a lot to think about when acquiring another business; the legal implications, tax considerations and how to effectively restructure the business, for example.

It makes sense to enlist the services of a business advisory specialist – an experienced expert who has seen it all before and can guide you through the acquisition process.

Liquidity

It’s critical to assess both the liquidity in the company you are acquiring, and the liquidity in your own business to ensure that it is sufficient to safeguard the continued growth and success of the combined businesses.

Without assessing your available funds, entering into an acquisition could put your business at risk and make the transaction unsustainable

Due Diligence

You can’t take any shortcuts with due diligence; it gives you the opportunity to investigate fully the business you are buying, validate what has been claimed by the seller and identify any red flags.

Companies planning to acquire a business should insist on receiving full financial and business disclosure from the seller in advance of the acquisition.

Due diligence should include details of the structure of the organisation; assets, audited financial statements, intellectual property, contracts, employee records and tax records.

Culture and integration

So often overlooked, but so important – is the culture of the business you are acquiring a good fit with your own?

If the cultures are very different, it is not necessarily a bad thing – provided you are aware of it and take steps to ensure that the two business integrate successfully.

Ensure that your combined workforce communicate openly from the start to establish an integrated and successful working relationship.

Are you considering acquiring a business?

We can help you finance it, get in contact today.

Learn more at newable.co.uk/money/finance

Business Plans & Documentation

Why Have a Business Plan?

Most, if not all corporates and big businesses run on 90-day plans based on their busines plan, vision, and mission. This is why we always hear comments like "sales were up in Q2 this year" or "compared to last year's financial report in Q4…" So, what's the point and where's the value in having a business plan?

Most savvy business leaders understand the value and necessity of strategic thinking and planning. This is something that's taught when studying business at university or college or when you fall into a new job role, but those of us that start a business without that training or experience are missing a trick when it comes to planning. Most of the business owners I talk to either haven't thought about detailed planning, can't see the value in it or just can't spare the time to complete such a task. I suspect that more often than not, it boils down to not actually knowing where to start and staring at a blank page doesn't help much either!

There are many planning tools and books to help guide us, such as Jim Collins and Jerry Porras' Big Hairy Audacious Goal, this is a blueprint for helping us hone in on an objective, or Michael Porter's Five Factor Analysis, which offers a model for companies to work out long-term viability by analysing the competitive advantage.

To get in the right frame of mind and to develop a plan with value, you must know where you want to take the business and a 90 day plan should help you build towards the vision of your actual business plan.

What Should be in Your Plan?

Most business owners start off by cramming too much information into their plan. The problem with the English language is we tend to add a lot of fluffy filling and it's just not needed or appreciated by the reader. The sole purpose of a business plan is to explain clearly and briefly what the business does, who it does it for, how it delivers it, and prove that it will work. It should also provide clear navigation and look as inviting as your favourite desert, so include some colour and pictures, make headings stand out and use bullet points to keep the focus.

Typically, you will need to answer the following questions and add the relevant information to satisfy the reader:

Have an executive summary, a list of products/services, achievements to date, a market analysis, a sales strategy, a competitor analysis, operational capacity, SWOT & PESTLE analysis, key personnel CVs and dynamics, risk management, financials, values & core purpose, core activities, improvements & changes, and planed reviews & evaluations.

Who's it for?

Depending on the different type of jobs you may have applied for, you would have needed to adjust your CV to suit their roles and organisations. It's the same for any business plan if you think of it as the businesses CV. Initially, you will develop a detailed plan that answers the list of questions mentioned above. It could end up 25 to 55 pages long, but who wants to read all that information? So, the vital information gets extracted and put into a short and to the point version. An investor usually requires a 2 to 6 page introduction to the business plan. If that excites them, only then will they be willing to see the full version or ask for specific details. This short version is sometimes referred to as a pitch deck and there are some good templates available if you look around. Try using Canva or google free templates for more choice https://www.canva.com/presentations/templates/pitch-deck/

Update your business plan every time there is a significant change and put something in the diary to review it every 6 months to make sure you are on track and focussed. A 90-day plan will keep you on target and should reflect small chunks of the business plan and vision. Don't get lost, use this as your business road map!

Can I get help with my business plan?

East London Business Place can help you explore and research the details you need to develop your business plan. It's a free service if you are based in a London borough as we are fully funded to support London based SME businesses. Writing your business plan should be an exciting experience and help you to realise your true potential but sadly, its a misunderstood process/document rarely completed with meaning and left in the top drawer. It's the foundations of the business to which you can build a solid business on, so get some professional help and build something that's fit for purpose and you can be proud of…

The Building Legacies programme is run by East London Business Place, a project set up to support London based SME businesses. Members will have full access to a dedicated business growth manager, who's available to coach and mentor them and the business. We can help you to be Procurement ready, connect you with potential buyers and support new growth opportunities, provide free training workshops and webinars, and networking, as well as meet the buyer events. So, join now by clicking here to sign up to the programme for your free support.

Author Bio

Robert Bowles is the Senior Operations Manager and a Business Growth Manager (BGM) for East London Business Place, looking after the Building Legacies programme. Robert specialises in - Business Planning, Mentoring and Business Growth.

Record Keeping

What Records Do I Need To Keep For My Start Up Business?

At Edwards Bailey Chartered Accountants we often get asked "what records do I need to keep for my start up business?"

Below we have detailed:

- What records you need to keep for your start up business.

- How to keep your financial records.

- Whether accounting software will be of benefit to you.

- What other software can make your record keeping easier and save you time.

What Records Do I Need To Keep For My Business?

HMRC state that you need to keep your financial records for at least 6 years, so what information do you need to keep?

Our advice to all our clients is that it better to keep too much, rather than not enough.

Below we have detailed the main records that you need to keep:

- Sales invoices

- Purchase invoices

- Receipts

- Bank statements

- Credit card statements

- Payroll records

- Payslips

- Employee records

- Mileage records

- VAT returns

- Year end accounts

- Tax returns

As you can see from the above there is a lot of information to keep and if you need to keep at least 6 years of records, you can very quickly run out of storage space or lose a room in your house to your financial records.

Below we cover ways to keep your financial records.

How Should I Keep My Accounting Records?

Historically you were required to keep paper copies of all your financial records, however you are now allowed to store records electronically.

This is the most cost effective way of maintaining your financial records and it also means that they will take up a lot less space in your home!

The issue with storing your accounting records electronically is a security breach or loss of computer data. You need to ensure that if you are keeping your records electronically you need to back up your data and store it in the cloud to reduce the risk of losing your information.

Should I Use Accounting Software?

Our team are experts in all major accounting software, whether it is Xero, QuickBooks Online or Sage our team are here to help.

Is using accounting software the right option for you?

For all start up businesses the biggest issue is keeping costs under control. Therefore our recommendation is that you do not pay for accounting software initially while you build your business. Using a simple Excel spreadsheet is sufficient until your business is more established.

Once your business is more established accounting software is a great way to save time and electronically store your financial records.

What Software Is There That Can Help Me Keep My Financial Records?

At Edwards Bailey Chartered Accountants we recommend a piece of software called Dext, formally known as Receipt Bank.

This simple piece of software gives you a cloud based storage system for your sales invoices. purchase invoices and receipts, but when you input your records into the system it automatically extracts all of the data you need such as:

- The invoice date

- The supplier

- The customer

- The net, VAT and gross amounts

- The due date

This means that you no longer have to spend hours manually typing out invoice details or inputting them into your accounting software.

Need Assistance With Your Accounting Records?

If you would like to discuss your accounting records with one of our Chartered Accountants please feel free to call us on 01708 200675, email us at info@edwardsbailey.co.uk or contact us via our website www.edwardsbailey.co.uk.

IT Systems and Security - LP Networks

LP Networks - Guest Blog Edwards Bailey

It's time for businesses to focus on their IT

We think it's safe to say that IT is an integral part of the operations of any business. Whether you are a small company sending emails from your laptop or phone and loading your business receipts onto Sage or QuickBooks, or a larger operation running remote workers using Cloud-based software, IT will play a part somewhere. In fact, if you take a moment to consider how your business would run without the Internet and computers, it could be quite a shock. Over recent years companies have come to take them for granted, freely accepting and integrating IT within their operations. Still, for many, they haven't considered the implications of what can happen when their IT systems fail.

An IT system failure can range from an Internet outage all the way through to a cyber or ransomware attack that renders all of a business' devices unusable. While these could all be described as inconveniences (in some cases disasters), what is more important is to consider the cost and impact on your business. The same can be said for poorly chosen software or apps that are included as a part of a bundle but are never used. In short, not focussing on IT has the potential to be expensive.

So, what can companies do to reduce the real and potential financial impact of failing or underused IT on their balance books? LP Networks offer several cost-effective solutions that can keep your business running the way you need it.

Remote IT Support

One of the first things that a business should consider is whether they have IT Support in place. Ideally, an IT Support service will be able to fix any problems that you have remotely, only sending out a qualified engineer if they can't fix the issue and working quickly to get your business up and running again. However, LP Networks take our IT Support Services one step further, working proactively to monitor IT systems, cutting potential cyberattacks and systems failures off at the pass. It just makes sense to stop a threat before it becomes a problem.

The other benefit of our IT Support Packages is that companies know exactly how much they cost every month and have a breakdown of the service they receive. Starting from as little as £40 per user per month, our LP Lite packages provide the support and reassurance that start-ups and SMEs need.

Cyber Essentials Certification

Cyber Essentials is a UK Government designed scheme that has been shown to guard against up to 88% of cyberattacks. Cyber Essentials is simple but highly effective, and becoming accredited enables a company to reassure their customers and clients that they take cybersecurity seriously.

To receive Cyber Essentials Accreditation, a business must prove that it is compliant in five key areas, which include security configurations, user access controls, and patch management. Accreditation can also be used as an example of GDPR compliance and is becoming a standard requirement when tendering for lucrative contracts.

As an accredited Cyber Essentials Certification Body, LP Networks guide and assist businesses through the certification process, ensuring compliance in all areas. We also provide user awareness training to make sure that the company remains compliant. Human error is one of the biggest causes of hacks and data breaches, with 80% caused by fraudulent emails, so training staff to recognise warning signs is one of the best defences a company can have.

Pay for what you need with MS Office

If you look at the desktop on your device, are there any programmes on there that you don't use but that you pay for as part of a package? Many companies find themselves paying subscriptions on software that they don't need purely because it's tied in with a programme that they do. It's frustrating to pay for something that you'll never use.

LP Networks can offer bespoke Microsoft Office Packages on a monthly subscription. This means that businesses can pay for the services they need and can increase their subscription as they grow. With no annual commitment or upfront costs for licence upgrades, it's the ideal option for any new business or SME.

Whatever the direction of your business is, it's important to find an IT Support Partner who understands how it feels to run and grow a company. LP Networks is just that and has seventeen years of experience in helping small and medium sized businesses achieve their goals. We believe in providing honest and outstanding IT Support and training. You can find out more about the services we offer on our website www.lpnetworks.com or you can call us on 0800 970 8980.

Quick Navigation

Get In Touch

If you would like to discuss the services we offer or for a no obligation quote please contact us using the details on the right.

"*" indicates required fields